If you’re in the market for a new mortgage or if you have one with an adjustable interest rate, you may worry that the Federal Reserve's efforts to decrease inflation will raise your housing costs.

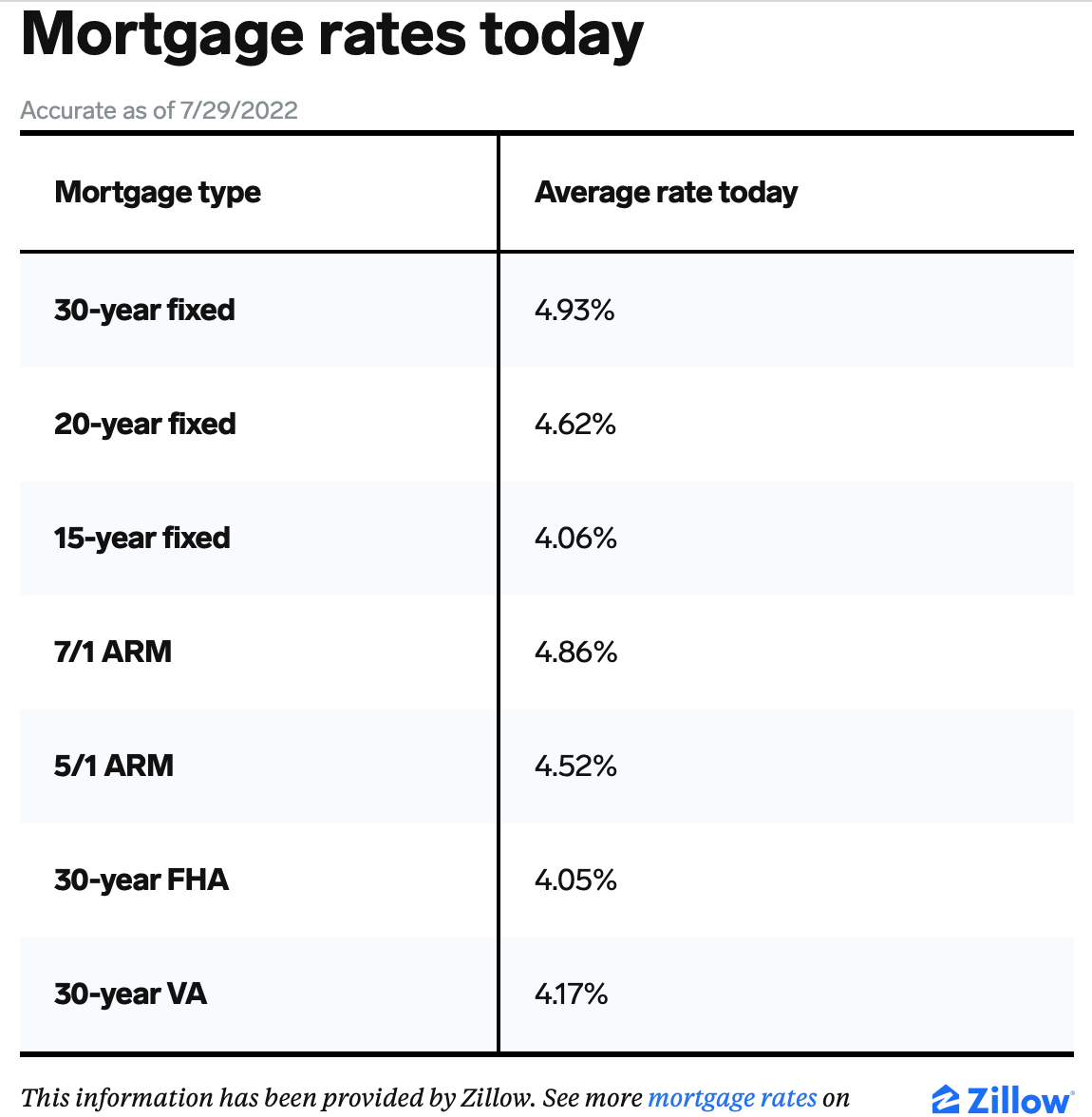

Economists say there is a link between the Fed’s moves and mortgage interest rates, but it’s misleading to focus on the Fed’s short-term interest rate increases. The average interest rate for a 30-year fixed mortgage was lower Wednesday than it was a week earlier, even though the Fed was poised to raise short-term rates for the fourth time in a little more than four months.

The Federal Open Market Committee did just that Wednesday, raising its target for the Federal Fund Rate — the amount that banks charge one another for overnight loans — to a range of 2.25% to 2.5%, up from 1.5% to 1.75%. Its target had been 0% to 0.25% until March.

That’s a significant jump, yet analysts don’t expect mortgage interest rates to respond much, if at all. That’s because the Fed’s interest-rate moves have only an indirect effect on mortgages and other long-term loans. They’re just one of multiple forces at play in mortgage interest rates.

The 30-year fixed rate dropped today to a 78-day low, even after the Fed rate was raised 0.75% on Wednesday.

The Fed’s role

Increases in the federal funds rate tend to ripple through the credit markets, including long-term loans such as mortgages. If you look at the interest rate for 10-year Treasury notes — which tends to move in the same direction as mortgage interest — you’ll see it rose slowly as inflation took off in late 2021 and early 2022, then jumped as the Fed started raising the federal funds rate in March.

But the interest rate on 10-year Treasurys, like the average rate for 30-year mortgages, peaked in mid-June and has eased back down, despite the Fed’s stated plan to raise the federal funds rate several more times this year. That disconnect points to a different force at play: the Fed’s handling of the mortgage-related assets on its balance sheet.

The Fed went on bond-buying binges during the 2007-09 recession and again during the pandemic, snapping up mortgage-backed securities and Treasury notes. Increasing the demand for those securities raised their prices, which translated into lower interest rates, said Paul Single, the senior economist at City National Rochdale. Those moves, combined with low inflation and other factors, helped push mortgage interest rates below 3%.

The Fed Rate increase is a planned action to fight inflation. The next Fed meeting will be in September to determine how the increase has affected the economy.

Now the Fed is going in the opposite direction. It stopped adding to its balance sheet in March and began to shrink its holdings. As the bonds mature or are redeemed by its issuers, the Fed will buy fewer new bonds to replace them. By September, it plans to shrink its holdings each month by $35 billion in mortgage-backed securities and $60 billion in Treasurys.

In other words, Single said, the Fed went from buying $120 billion worth of securities a month to allowing $95 billion a month to roll off its books. That’s more than $2.5 trillion a year in bonds that “someone else would have to buy,” Single said.

The Fed has been explicit about its plans, though, and securities prices now reflect the expected effects on supply and demand. Any change in how Fed leaders talk about their plans for mortgage-backed securities could cause more shifts in interest rates.

And if the Fed were to start actively selling its mortgage-backed securities, instead of just letting its portfolio shrink naturally, “it likely would have a fairly big negative impact on rates,” meaning mortgage interest rates would be driven up.

What about inflation?

The Fed’s latest increase pushed the federal funds rate into what economists consider neutral territory, neither stimulating the economy nor slowing it down, Single said. But the next few increases planned by the Fed will push the rate “well into the restrictive territory,” Single said, and “all of that is going to have an impact on the whole economy.”

The Fed is trying to break the economy’s inflationary fever without pushing the country into a recession, but the usual indicators of economic health are confusingly jumbled. Gross domestic product is slumping and consumer confidence has cratered, but unemployment remains low, corporate profits are largely solid and consumer spending continues to grow, albeit slowly.

If the Fed manages to take the steam out of inflation, that should lower mortgage interest rates. In fact, investors are showing signs that they believe inflation may have reached its peak.

But even if we do turn the corner on inflation, don’t expect to see interest rates drop right away. It takes the market a very long time to fully forgive a big move like this.