If you have tuned into the real estate conversations happening around town you'll notice that one big word keeps popping up: appreciation. Simply put, home appreciation refers to the increase in a property's value over time. Some large-scale factors that affect appreciation include: inflation, increased job opportunities in the market, and development in our market. A small-scale factor that affects a home's appreciation is home improvements like a bathroom or kitchen renovation, replacing old windows, or adding a favorable feature like a detached garage or an ADU (accessory dwelling unit).

But what about the market crash that's about to happen?

Well, that's not quite what we are going to see and here's why:

The market crash of 2008 had high inventory, low demand, and a whole lot of unethical mortgage practices. Right now, we have low inventory, high demand, and tighter mortgage procedures so the real estate landscape couldn't be any more different.

But we also have...high inflation.

In fact, the inflation rate in 2008 was 3.84%. The current year-over-year inflation rate (2021 to 2022) is now 7.04%. If this number holds, $100 today will be equivalent in buying power to $107.04 next year (source).

And you know what high inflation means?

Higher rates of appreciation.

Now, for the sake of everyone's wallet and rising costs all around, what we hope is that the rate of inflation slows down and so, too, will home appreciation as a result. The feds are feeling the same way and that is why interest rates are slowly on the rise. This incremental increase in interest rates will help offset a large decrease in home appreciation due to a "crash".

So if the rate of home appreciation slows down, is buying a home in Denver still a good investment?

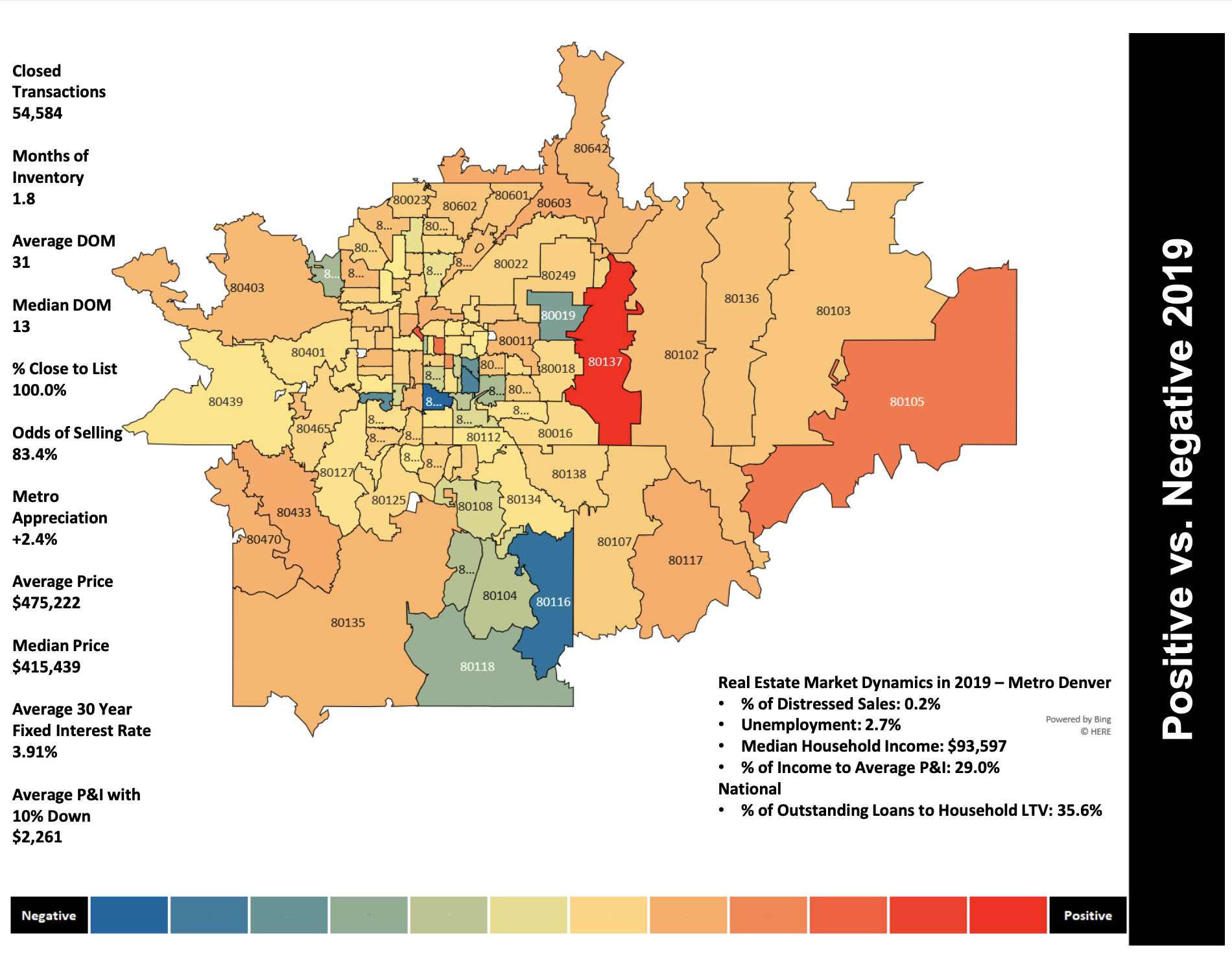

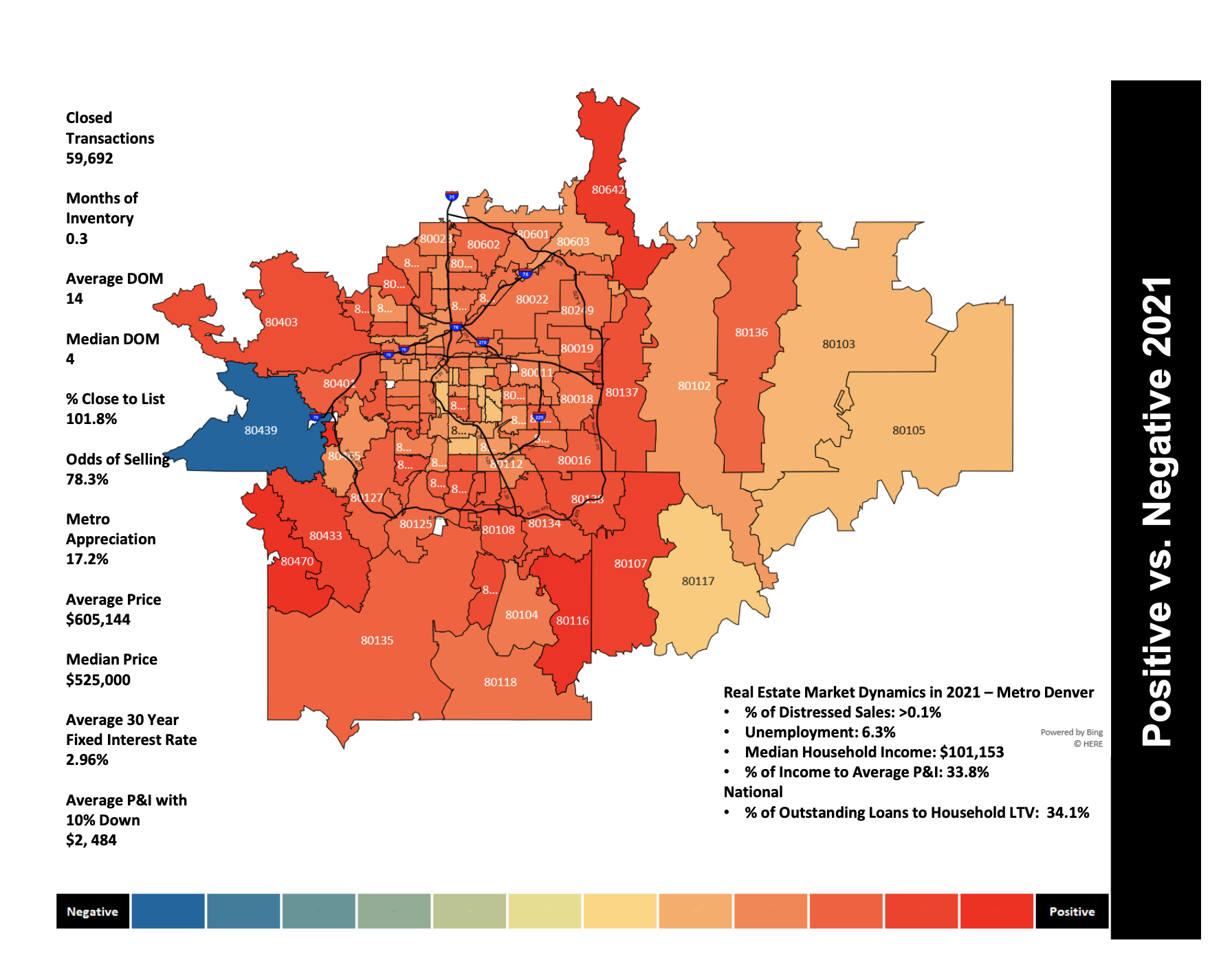

We think so based on the numbers. Check out the "Positive vs. Negative Appreciation" maps of Denver for the last five years below, and you'll know your answer!

*All Denver Real Estate Market Information graciously provided by Megan Aller, First American Title Company, and the Denver Metro Association of Realtors.